Home Equity Loans vs. Equity Loans: Understanding the Distinctions

Home Equity Loans vs. Equity Loans: Understanding the Distinctions

Blog Article

Debunking the Credentials Refine for an Equity Finance Authorization

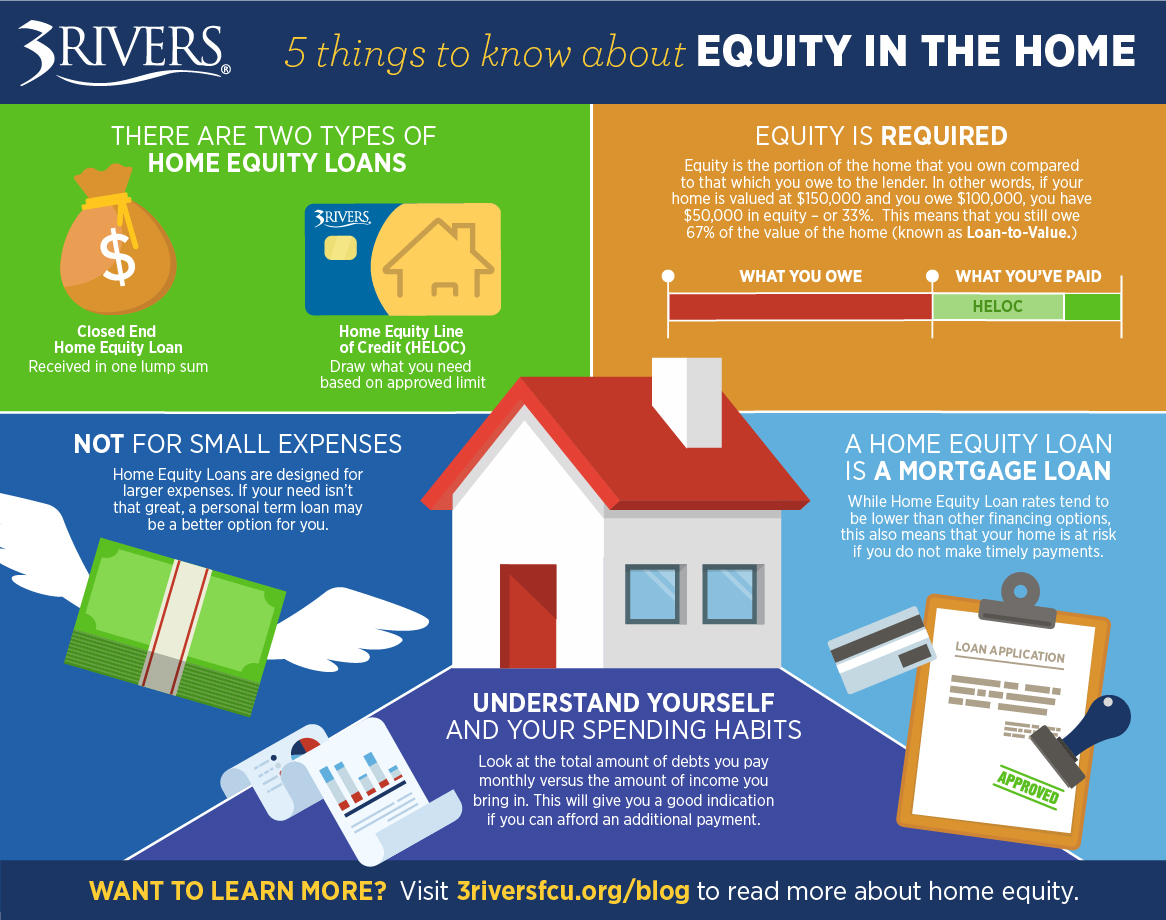

Navigating the credentials process for an equity financing approval can usually seem like understanding a complex challenge, with various aspects at play that figure out one's qualification. Recognizing the interplay in between debt-to-income proportions, loan-to-value proportions, and other essential standards is critical in protecting authorization for an equity car loan.

Secret Qualification Criteria

To get an equity financing approval, meeting particular crucial qualification criteria is important. Lenders normally require applicants to have a minimum credit history, commonly in the array of 620 to 700, relying on the establishment. A strong credit report, showing an accountable settlement track document, is likewise vital. In addition, lending institutions analyze the candidate's debt-to-income proportion, with a lot of liking a proportion listed below 43%. This demonstrates the customer's capability to handle extra financial obligation sensibly.

Additionally, lenders evaluate the loan-to-value ratio, which contrasts the quantity of the funding to the appraised worth of the residential property. Meeting these essential qualification criteria raises the possibility of safeguarding approval for an equity finance.

Credit History Value

Credit report generally range from 300 to 850, with greater scores being more favorable. Lenders usually have minimal credit rating demands for equity fundings, with ratings over 700 typically considered excellent. It's vital for applicants to assess their debt reports on a regular basis, inspecting for any kind of errors that could adversely affect their ratings. By preserving a good credit history via timely costs payments, reduced credit history utilization, and responsible borrowing, candidates can enhance their opportunities of equity funding authorization at competitive prices. Recognizing the significance of credit rating and taking steps to enhance them can considerably influence a customer's monetary possibilities.

Debt-to-Income Proportion Evaluation

Given the critical duty of credit ratings in identifying equity lending authorization, one more crucial facet that loan providers assess is a candidate's debt-to-income ratio evaluation. A reduced debt-to-income ratio indicates that a debtor has more revenue available to cover their financial debt repayments, making them an extra attractive prospect for an equity car loan.

Lenders typically have certain debt-to-income ratio demands that consumers should meet to certify for an equity finance. While these needs can vary among loan providers, a common standard is a debt-to-income proportion of 43% or reduced. Customers with a greater debt-to-income proportion may deal with obstacles in securing approval for an equity financing, as it suggests a higher danger of failing on the car loan. Equity Loan. For that reason, it is necessary for candidates to assess and potentially minimize their debt-to-income proportion prior to using for an equity lending to raise their possibilities of authorization.

Home Evaluation Requirements

Evaluating the value of the home with an extensive evaluation is a basic step in the equity lending approval process. Lenders need a residential property appraisal to make certain that the home provides sufficient collateral for the lending quantity asked for by the customer. Throughout the building evaluation, a certified evaluator examines different factors such as the property's problem, size, place, comparable property worths in the area, and any kind of special features that might influence its overall well worth.

The home's assessment value plays an essential duty in identifying the optimum amount of equity that can be obtained against the home. Lenders commonly need that the evaluated value satisfies or exceeds a specific percent of the funding quantity, referred to as the loan-to-value proportion. This ratio assists minimize the lender's threat by ensuring that the residential property holds enough value to cover the financing in case of default.

Eventually, a comprehensive residential property appraisal is important for both the lender and the debtor to properly assess the home's worth and figure out the usefulness of providing an equity car loan. - Equity Loan

Recognizing Loan-to-Value Proportion

The loan-to-value ratio is an essential monetary statistics made use of by lending institutions to evaluate the risk related to supplying an equity finance based on the residential or commercial property's appraised worth. This ratio is computed by dividing the quantity of the lending by the assessed worth of the home. As an example, if a residential property is appraised at $200,000 and the funding quantity is $150,000, the loan-to-value ratio would be 75% ($ 150,000/$ 200,000)

Lenders use the loan-to-value ratio to identify the degree of threat they are tackling by providing a funding. A greater loan-to-value proportion shows a higher risk for the lender, as the customer has less equity in the residential or commercial property. Lenders normally favor reduced loan-to-value ratios, as they navigate to this website offer a cushion in situation the borrower defaults on the building and the lending needs to be sold to recover the funds.

Customers can additionally take advantage of a lower loan-to-value ratio, as it might cause far better finance terms, such as lower rate of interest prices or lowered fees (Alpine Credits). Comprehending the loan-to-value proportion is vital for both lending institutions and debtors in the equity funding authorization process

Conclusion

In final thought, the credentials process for an equity loan authorization is based on key qualification criteria, credit rating score relevance, debt-to-income proportion evaluation, residential property appraisal requirements, and recognizing loan-to-value ratio. Recognizing these aspects can assist individuals browse the equity funding approval process a lot more effectively.

Recognizing the interplay between debt-to-income proportions, loan-to-value proportions, and other vital requirements is critical in safeguarding authorization for an equity car loan.Given the important function of debt ratings in figuring out equity car loan authorization, one more important aspect that loan providers analyze is a candidate's debt-to-income ratio analysis - Alpine Credits Canada. Borrowers with a higher debt-to-income proportion might face difficulties in safeguarding authorization for an equity car loan, as it recommends a greater risk of failing on the funding. It is important for applicants to examine and possibly lower their debt-to-income ratio before applying for an equity funding to raise their chances of approval

In conclusion, the qualification process for an equity finance approval is based on vital qualification requirements, credit scores rating relevance, debt-to-income proportion evaluation, home assessment needs, and recognizing loan-to-value proportion.

Report this page